Custom Private Equity Asset Managers - Truths

(PE): investing in companies that are not openly traded. About $11 (https://www.webtoolhub.com/profile.aspx?user=42369301). There may be a couple of points you don't understand regarding the market.

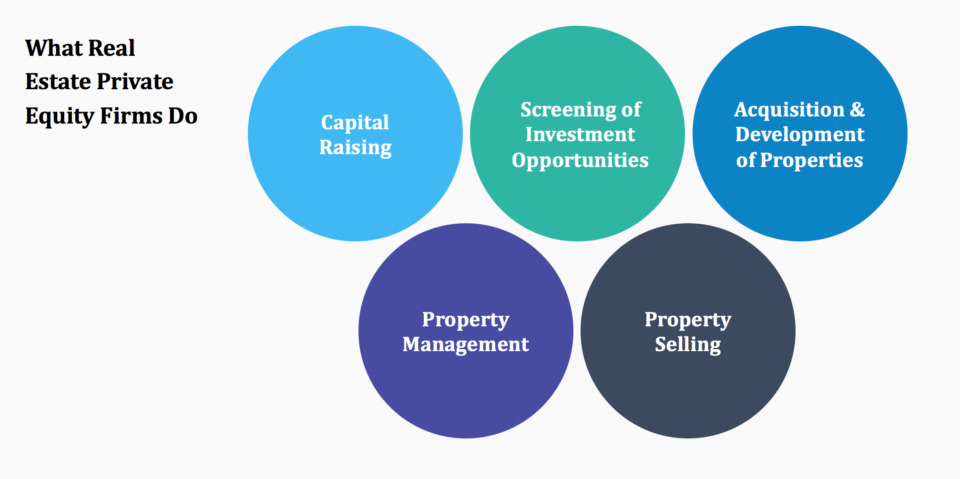

Private equity firms have a variety of investment choices.

Because the most effective gravitate towards the larger deals, the middle market is a considerably underserved market. There are much more vendors than there are extremely experienced and well-positioned money experts with substantial customer networks and resources to handle an offer. The returns of personal equity are generally seen after a couple of years.

The Ultimate Guide To Custom Private Equity Asset Managers

Flying listed below the radar of large international firms, a number of these little firms usually provide higher-quality customer solution and/or niche services and products that are not being provided by the huge conglomerates (https://www.mixcloud.com/cpequityamtx/). Such benefits draw in the interest of personal equity firms, as they possess the insights and savvy to manipulate such opportunities and take the business to the following degree

A lot of managers at portfolio companies are provided equity and benefit settlement structures that compensate them for hitting their monetary targets. Exclusive equity chances are often out of reach for individuals that can't invest millions of dollars, yet they should not be.

There are laws, such as limits on redirected here the aggregate quantity of money and on the variety of non-accredited investors. The private equity company brings in several of the finest and brightest in company America, including leading performers from Lot of money 500 firms and elite monitoring consulting firms. Law practice can also be hiring premises for private equity works with, as accountancy and lawful abilities are necessary to complete bargains, and deals are extremely searched for. http://go.bubbl.us/ddd0a6/87fd?/New-Mind-Map.

An Unbiased View of Custom Private Equity Asset Managers

Another negative aspect is the absence of liquidity; once in a private equity transaction, it is difficult to get out of or market. There is a lack of versatility. Exclusive equity likewise features high fees. With funds under administration currently in the trillions, personal equity companies have ended up being appealing investment cars for well-off individuals and institutions.

For decades, the qualities of private equity have actually made the asset class an attractive recommendation for those who could participate. Currently that accessibility to private equity is opening up to even more specific financiers, the untapped possibility is coming true. The question to consider is: why should you invest? We'll begin with the primary debates for buying personal equity: How and why personal equity returns have historically been greater than various other properties on a variety of degrees, Exactly how consisting of personal equity in a portfolio influences the risk-return profile, by aiding to branch out against market and intermittent threat, After that, we will certainly lay out some crucial factors to consider and dangers for personal equity financiers.

When it concerns presenting a new possession right into a profile, the many standard consideration is the risk-return profile of that possession. Historically, exclusive equity has actually exhibited returns similar to that of Arising Market Equities and greater than all other traditional possession classes. Its reasonably reduced volatility paired with its high returns produces a compelling risk-return profile.

The smart Trick of Custom Private Equity Asset Managers That Nobody is Discussing

Actually, private equity fund quartiles have the largest variety of returns across all alternative possession courses - as you can see below. Technique: Internal price of return (IRR) spreads calculated for funds within vintage years independently and after that averaged out. Typical IRR was computed bytaking the average of the mean IRR for funds within each vintage year.

The effect of adding private equity right into a profile is - as constantly - reliant on the portfolio itself. A Pantheon research study from 2015 recommended that including exclusive equity in a profile of pure public equity can open 3.

On the other hand, the finest personal equity companies have accessibility to an even larger swimming pool of unknown chances that do not face the very same analysis, in addition to the sources to perform due diligence on them and identify which deserve buying (Private Asset Managers in Texas). Investing at the ground flooring means greater threat, but also for the business that do prosper, the fund benefits from greater returns

Custom Private Equity Asset Managers for Beginners

Both public and exclusive equity fund managers dedicate to investing a percentage of the fund yet there stays a well-trodden issue with aligning interests for public equity fund administration: the 'principal-agent issue'. When an investor (the 'primary') hires a public fund manager to take control of their funding (as an 'representative') they hand over control to the manager while retaining ownership of the properties.

In the instance of exclusive equity, the General Partner doesn't simply make a monitoring fee. Personal equity funds likewise minimize an additional form of principal-agent issue.

A public equity capitalist ultimately desires one point - for the administration to raise the supply rate and/or pay rewards. The capitalist has little to no control over the choice. We revealed above the number of exclusive equity techniques - particularly bulk buyouts - take control of the operating of the business, making certain that the lasting value of the firm precedes, raising the roi over the life of the fund.